Pig industry crisis - NPA blog, Dec 23, 2022: Carcase weights coming down as SPP continues to rise; Recognition for pig farming's 'front row'

22nd Dec 2022 / By Alistair Driver

Updates on the latest developments as NPA seeks solutions to crisis hitting pig sector.

December 23, 2022

Recognition for pig farming's formidable ‘front row’

Pig farming’s most formidable ‘front row’ were honoured by campaigning pig farming colleagues, with a presentation to mark their support this year.

Former NPA chair Richard Longthorp, NPA vice chair Hugh Crabtree and veteran industry campaigner John Cusson have provided a ‘safety blanket, counselling service, fountain of knowledge and experience in campaigning’, as the #BiteIntoBritish campaign has raised awareness over the industry’s plight over the past year or so, according to Anna Longthorp.

More HERE

December 22, 2022

SPP up again, as carcase weights come down

The SPP was up again, but arguably the most interesting element of this week's market data was a further 1kg drop on carcase weights, amid reports of pigs being brought forward in the run-up to Christmas.

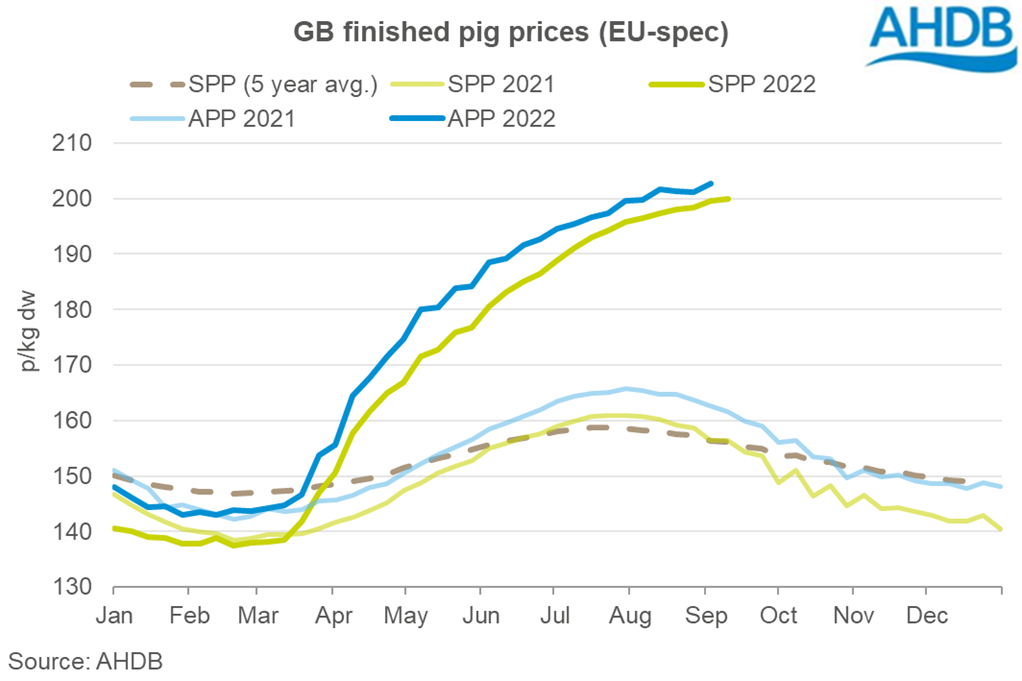

The SPP was up by a further 0.39p in the week ended December 17 to reach 200.48p, the second successive rise after two weeks of downward movement.

The average price index is now 59p ahead of a year ago and appears to be gaining momentum, although remains well below AHDB’s average cost of production estimate of 232p/kg for November.

The APP, however, is going the other way. After barely moving over the previous two weeks, it dropped back by a substantial 0.72p to 204.55p/kg during the week ended December 10. With the SPP up by 0.34 that week, the gap between the two price averages closed to 4.5p.

The European is steady and still slowly on the rise. The EU reference price continues its upward movement, recording a 0.65p increase to reach 177p/kg in the week ended December 18, with Spain showing the biggest upward movement. The gap between the EU and UK reference prices continues to close, now standing at 25.6p.

AHDB's estimated weekly slaughterings totalled 195,871 during the week ended December 17, 4,000 up on the previous week and 4,700 up on 2021 levels, but 1,300 down on 2020.

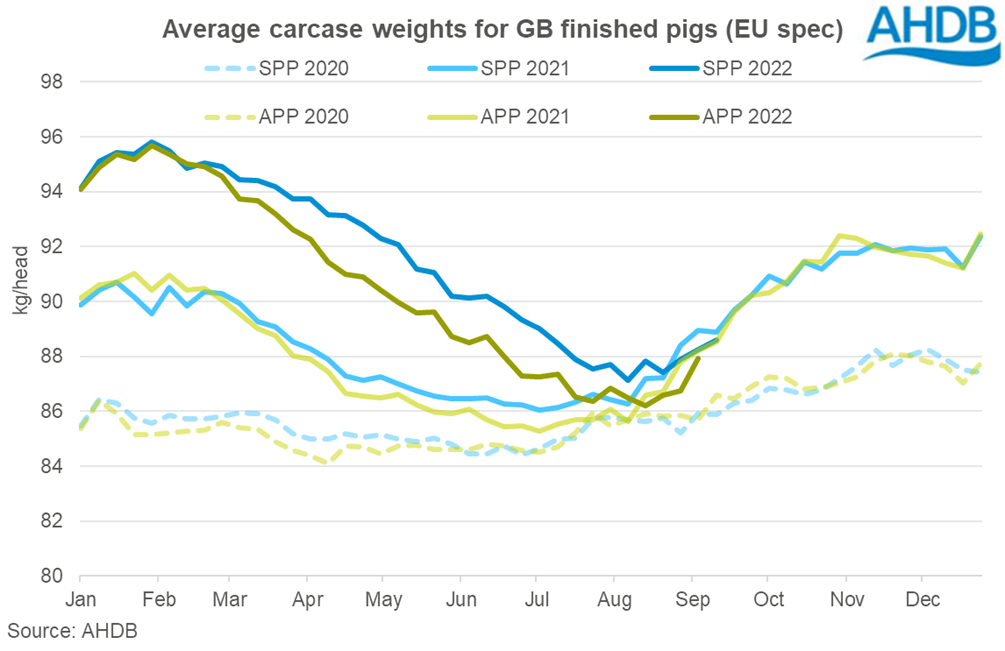

Amid anecdotal reports from the trade of the long-awaited pig shortage starting to be seen and pig pigs increasingly being brought forward to fill the gap in this period, the average carcase weight fell by 1kg over the week to 86.83kg.

This is the ninth successive weekly fall, putting it more than 4kg below mid-October levels of 90.88kg.

December 16, 2022

Defra June census - breeding herd falls to 20-year low

The UK female breeding herd decreased by 14% to a 20-year low in the year to June 2022, according to new figures published by Defra.

The figures are based on the June agricultural census, although there is some uncertainty over the data as estimated figures have been used for both Scotland and Northern Ireland.

The figures show, overall, a 2.5% reduction to 5.2 million pigs in the UK. The reduction is driven largely driven by a 15% fall in the number of breeding pigs.

More HERE

December 15, 2022

SPP bounces back to top £2/kg once again

Following two weeks of falls that the SPP dip below £2/kg for the first time since mid-September, the SPP has bounced back, rising by 0.34p to reach 200.09p/kg in the week ending December 10.

This follows some more positive signals of late, with the EU market looking healthier and UK processor contribution prices unchanged last Friday after the recent flurry of reductions. In his Friday update, industry analyst Peter Crichton noted that UK spot bacon prices have ‘shot up’ to between 205p/kg and 210p/kg, which he described as ‘a big step forward’, predicting this would filter through to the SPP.

The SPP is now 58p ahead of a year ago.

The APP is more stable. After a small drop of 0.15p it remained unchanged at 205.37p/kg during the week ended December 3, putting it 5.5p ahead of the SPP.

The EU reference price for the week ended December 4 was up 3p to 175.1p/kg, reflecting positive movement in Germany, the Netherlands and elsewhere, which closed the gap on the equivalent UK prices to 28p.

AHDB has just published its latest cost of production estimates for November, showing it remained unchanged on October at 232p/kg, as falls in the wheat price were offset by increases in interest rates, while energy and fuel costs remain high. AHDB estimated that producers were losing, on average £23 to £29 per pig.

Wheat prices remain below £240/tonnes, which while still historically high, is an improvement on recent months.

The downward trend in carcase weights continues, with average weights down by a further 0.53kg to 87.81kg in the week ending December 10, 3kg lower than in late-October.

Estimated GB pig slaugherings for the week ending December 10 were similar to the previous week at just short of 187,000 head, although this was a notable 9,000 to 10,000 down on the same weeks in 2020 and 2021.

December 8, 2022

Anna calls for fairness in the supply chain on BBC Look North

Having appeared on LBC's James O'Brien show on Tuesday (see below), Yorkshire producer Anna Longthorp was interviewed by BBC Look North about the pig sector's plight on Wednesday.

Anna, one of the driving forces behind the Bite Into British campaign and a recent Chris Brant Award winner, told the programme that the imbalance of power between retailers and producers remains.

"The pressure is just immense and it's been going on for so long. We thought it would be over by now, but it's like we being pummelled. There's loads and loads of profit going on at the top but the farmers are just losing money hand over fist," she said.

Retailers told the programme they were also concerned about the cost of living crisis facing consumers and wanted to keep prices down.

"These big supermarkets consistently make mega profits, while farmers have been losing money for two years, so there's plenty of money in that supply chain. It's case of distributing that fairly," Anna responded,

"We don't want people to pay more for it, but if the supermarkets can't change that percentage profit margin, if they won't do that, then they're showing responsibility's towards consumers, I would argue that a large corporation like that should also show a moral responsibility towards their suppliers."

You can view the feature (approx 1 min, 40 seconds) HERE

Big reduction takes SPP below £2/kg mark

The EU-spec GB SPP recorded its biggest drop since early September to drop below £2/kg for the first time in nearly three months.

The average price index fell back by 0.62p to 199.74p/kg in the week ending December 3, 2022. This ends the run since the SPP breached the £2 barrier during the week ended September 17, where it has shifted up and down by tiny margins to sit between 200p/kg and a high of 200.72p/kg.

While the latest figurewill be a disappointment, it comes as little surprise on the back of a series of reductions in processor weekly contribution prices. Woodheads-Morrisons has come down by 10p over the past few weeks, while Karro's contribution price of 167p/kg is now around 33p below the average pig price.

The SPP is now 57p ahead of a year ago.

Having risen for three weeks in a row, the APP was down by 0.15p to 205.37 during the week ended November 26, putting it just under 5p ahead of the SPP. The APP reporting is a week behind the SPP, so it may follow the same trend next week, however.

The better news for pig producers is that wheat prices continue to fall, quoted by AHDB today at £238/tonne for January, although this won't benefit producers who bought wheat forward at significantly higher prices.

With soya, energy, fuel and other costs remaining high, average prices, in all likelihood, remain well below the average cost of production. The average full economic cost of production was estimated by AHDB at 237p/kg in October.

The UK pig price remains under pressure from significantly cheaper EU imports, although EU prices have started to rise again, led by a 5 euro-cents increase in Germany last week to stand at €2/kg (172p/kg), with Belgium and the Netherlands also seeing notable increases.

The EU reference price is a week behind. The latest, for the week ended November 27, was fractionally down to 172.08p, 30p below the UK equivalent, although this gap is likely to have closed since.

The downward trend in carcase weights continues, with average weights down by a further 0.46kg to 80.34kg in the week ending December 3.

Estimated GB pig slaugherings for the week ending December 3 were 7,000 lower than the previous week at just short of 187,000 head, although this was 2,700 up on the same week in 2021.

December 7, 2022

Anna updates LBC listeners on pig industry crisis

Great stuff from Anna Longthorp, recent winner of the Chris Brant Award and one of the driving forces behind the #BiteIntoBritish campaign, who phoned into LBC's James O'Brien show yesterday.

Anna began by explaining, in response to a previous call, that pig farmers are not subsidised and went onto explain what has been happening within the industry over the past year, including the issues around supply chain relations.

The presenter clearly felt he had learned a lot from the six-minute call and expressed sympathy over what has been happening. "A country full of food banks is burying pork because the supply chain is such an almighty mess. It's incredible, isn't it?" he said at one point.

He even surprised Anna with his knowledge (via a listener) of Anna's Happy Trotters. This is well worth a listen.

To do so Click HERE

Anna and others behind the social media campaign continue to spread some important messages via the #BiteIntoBritish hashtag and @BiteIntoBritish account, which you can follow on Twitter.

December 1, 2022

SPP dips again

The SPP is back to where it was two weeks ago as it fell back by 0.36p to 200.36p/kg in the week ending November 26, 2022.

There has been a consistent pattern of small ups followed by small downs, as the average pig price remains within the very narrow band of 200-200.7p/kg where it has been since in mid-September. The SPP is just over 57p ahead of a year ago.

The APP has now risen for three weeks in a row - it was up by a healthy 0.53p during the week ended November 19, to reach 205.41p/kg, 4.7p ahead of the SPP.

Average prices remain well below the average cost of production, however, estimated by AHDB at 237p/kg in October.

The UK pig price remains under pressure from significantly cheaper EU imports. Last Friday saw three of the big pork processors reduce their contribution prices.

During the week ended November 20, the EU reference price fell by a further 0.7p to reach 172.09p/kg, meaning the gap between it and the equivalent UK reference price stood at a gaping to 29.5p.

The downward trend in carcase weights continues, with average weights down by a notable 0.57kg to 80.8kg in the week ending November 26.

Estimated GB pig slaugherings were up by 17,000 head on the previous week to nearly 194,000 head, slightly below 2021 levels.

November 24, 2022

SPP reaches new high, but remains well short of rising costs

The SPP has reached a new record high, after a 0.35p rise in the week ending November 19 took it to 200.72p/kg.

The SPP has barely moved since passing the £2/kg mark in September, as a sequence rises and falls following each other has kept it within a very narrow band.

The SPP is now just over 56p ahead of a year ago. But while a record SPP would usually be a cause for celebration, the reality is that the average pig price remains well below average costs, according to new AHDB data.

It shows spot compound feed prices rose in October, which together with significant increases in energy prices and interest rates, took the estimated full economic cost of production to 237p/kg deadweight, up from 232p/kg in September. That equated to average losses of around £28 to £33 per pig.

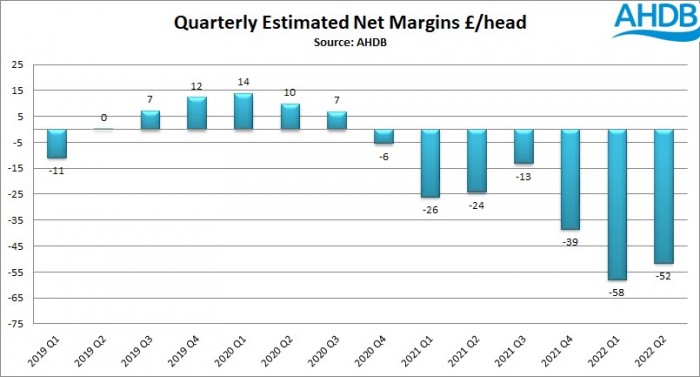

AHDB has also published net margin figures for Q3, showing an eight successive quarter of losses, with total losses over the last two years now estimated at £737m.

The full estimated economic cost of production for Q3 was 227p/kg deadweight, with average losses per slaughter pig estimated at -£23. This was, at least, an improvement on losses of in excess of £50/pig in Q1 and Q2, but of little consolation to those on the front line.

Meanwhile, the EU reference price increased for the first time in six weeks, putting on 1.36p to reach 172.81p/kg in the week ending November 13, with the gap to the equivalent UK reference price narrowing to 28.5p.

The downward trend in carcase weights continued, with average weights down by a tiny 0.05kg to 89.37kg in the week ending November 12.

Estimated GB pig slaugherings were down just over 2,000 head on the previous week to just below 177,000 head, more than 6,500 head fewer than a year earlier.

November 23, 2022

National Pig Awards

The National Pig Awards recognised the pig industry's talent and achievments in London last night, with plenty for the NPA to celebrate.

You can read our report HERE and more on the Pig World website HERE

Meanwhile, there have been plenty of other developments over the past couple of days.

- Danish Crown is to invest £100 million in a new bacon and gammon processing facility in Rochdale, Greater Manchester, with the latest processing technology to slice and pack bacon and gammon t‘produced to UK welfare and food safety standards’.

- Cranswick's revenue grew by nearly 12.4% (10.7% like-for-like) to reach £1.116 billion in the 26 weeks to September 24. However, adjusted profit before tax was down 3.4% to a still very healthy £66 million. The company is now 40% self-sufficient in its pig production capabilities, as it has continued to invest in capacity since the spring.

- The British Pig & Poultry Fair is moving to the NEC in 2024.

November 21, 2022

Mixed news on the market

There was mixed news on the market on Friday.

Woodheads reduced its weekly contribution price by 5p/kg to 185p. According to industry commentator Peter Crichton, this went down ‘like a lead balloon with producers’.

The SPP remains at around the £2/kg mark, despite falling pig supplies, according to TVC, which described the situation as 'nonsensical'. Average prices remain well short of costs.

The better news was that while the EU pig market remains static, cull sow prices were up by around 5p last week, thanks to an increase in the German price.

China to seek more imports, as pig production takes a hit?

China is expected to increase its pork imports in the coming months, as its pig herd is hit by the knock-on effect of industry losses suffered last year.

The reduction in pig output in China appears to be larger than official data suggests, industry experts claim.

Breeding company Genesus believes the sow liquidation is greater than reported, estimating that the sow herd shrank by between 6 million and 8 million head. "We all need to watch China; we expect increased sales due to their pork shortfall," Jim Long, chief executive at Canada's Genesus Inc, a supplier of breeding pigs to China, said last week.

Full story HERE

November 17, 2022

SPP unmoved

The EU-spec GB SPP has remained confined within a very narrow band of 200p-200.55p/kg since it breached the £2/kg barrier in mid-September.

And there is still no sign of it shifting. It was virtually unchanged in the week ending November 12, 2022, dipping by just 0.02p to 200.37p – continuing the trend of small increases followed by small dips.

The SPP is now 56p ahead of a year ago, however.

The APP was up by 0.56p during the week ended November 5, to reach 204.58p/kg, 4.2p ahead of the SPP.

However, producers continue, on average, to lose money on every pig sold. The latest figures from AHDB estimated an average cost of production for October of 232p/kg, up from 224p/kg in September, meaning producers were losing on average, around £26 to £28/pig.

EU prices continue to fall, as the impact of poor consumer demand and retail price inflation have more than outweighed reduced supplies. The decline appears to be slowing, however. The EU reference price was down just 0.7p to 171.47p/kg in the week ending November 6 - the gap to the equivalent UK reference price is growing and is now just short of 30p.

The downward trend in carcase weights continued, with average weights down 0.14kg to 89.32kg in the week ending November 12.

Estimated GB pig slaugherings stood at 179,150 in the week, 5,000 up on the previous week, and 2,000 up on a year ago.

November 15, 2022

Eustice admits Australia trade deal was 'not very good for UK'

Former Defra Secretary George Eustice has acknowledged that the Australia trade deal was 'not very good for UK', as he launched a stinging attack on former Prime Minister and International Trade Secretary Liz Trusl.

The deal included giving Australia or New Zealand full access to the UK market to the beef and sheep market, albeit phased in over 15 years. Yet Australia still bans the import of British beef and there was virtually nothing in return for UK farmers.

While pork was not a part of the deal, with Australia not being significant exporters, the fear within the pig industry was that could set a dangerous precedent in future trade deals.

Mr Eustice, who was sacked by Mrs Truss when she became Prime Minister, told a Commons debate that: "The first step is to recognise that the Australia trade deal is not actually a very good deal for the UK.

“Unless we recognise the failures that the Department for International Trade made during the Australia negotiations, we won't be able to learn the lessons of future negotiations.

"There are critical negotiations underway right now notably on CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) and on Canada, and it is essential that the Department for International Trade does not repeat at the mistakes it made."

More HERE

Pig production down slightly in October, compared with last year

UK pig production was just over 1% down on last year in October. Defra figures show the UK produced 85,900 tonnes of pig meat in October, 1,200 tonnes (1.4%) up on September figures, but 900 tonnes (1.1%) down on October 2021.

Clean pig slaughter for October stood at 926,000 head, up 5,400 head (0.6%) on September figures, but 7,200 head (0.8%) down on October 2021. However, year to date throughput is on a par with last year, at 9.3 million head, AHDB analyst Charlotte Forkes-Rees said.

Weekly slaughtering numbers are expected to decline as the year goes on, on the back of figures published by Defra showing an 18% drop in the breeding herd in the year to June.

Carcase weights of clean dressed pigs increased for the second month in a row, averaging 89.6kg.

Production for the year to October has reached an estimated 874,000 tonnes, up 23,000 tonnes (2.7%) on the same period last year.

More HERE.

November 14, 2022

Charlie discusses energy costs pressures on Countryfile

Northamptonshire nucleus pig breeder and NPA member Charlie Thompson has discussed the impact of energy costs on finances in a BBC Countryfile feature.

Charlie told presenter Charlotte Smith his energy bills had trebled in the space of less than half a year, on top of soaring feed and fuel costs and the ongoing impact of Brexit on the business.

He explained how it requires a lot of energy to heat rooms for young pigs to 26 degrees, and then, as they get older and produce more heat, it is also expensive to do the opposite and pump heat from the rooms and ventilate them properly with fans.

You can view the feature HERE, from 10 mins.

"We've got 7000 pigs that constantly need feeding, water, ventilation and heating. The power demands are just going up astronomically up in terms of the cost of everything," Charlie said.

"Across the last five years, we were looking at around £50,000 per year for our energy. In April, it went up to £150,000 and, if we had the prices we were paying in September for a whole year, we would be looking at £250,000 a year.

"This is on top of multiple other costs over the last few years," he said, citing Brexit issues, which are still not resolved, and the impact of the Ukraine war on feed prices. "You can deal with one of these, but dealing with all these things is just pushing us over the edge."

The farm has some solar panels, but cannot afford other renewable sources, such as wind power, due to the huge capital costs involved. Charlie said they have even given 'serious consideration' to using a diesel burning generator to keep costs down, which he said would be cheaper than the prices for energy they are paying at the moment.

The Government has capped the unit cost of energy for businesses, but this will only last until next spring.

November 11, 2022

Defra data highlights pressure on pig farm incomes

Pig farm incomes plummeted by 75% in 2021/22,,as input costs soared, in stark contrast to rising profitability across the other farming sectors, new Defra figures show.

Defra’s average Farm Business Income figures for England show income for specialist pig farms plumetted to £11,800 in the previous year from a relatively comfortable £48,000 the previous year. It is the lowest figure recorded over the past decade.

The figures show that pig producers made losses of, on average, nearly £31,000 from pig farming alone during the year, as rising input costs have significantly outpaced output.

The overall figure was bolstered by increased income from diversification,agri-environment payments and the Basic Payment.

In an otherwise good year for agriculture, the average income across all farm types in England was £86,000, up 67%, as all other sectors recorded increases. Average profits of in excess of £120,000 were recorded by the cereals, general cropping, dairy and poultry sectors.

More HERE

November 10, 2022

SPP inches up as sequence continues

The recent up and down trend continues as the EU-spec GB SPP rose by 0.17p in the week ending November 5, taking it to 200.39p.

This followed the previous week's fall of 0.22p, on the back of a small rise the week before and so on. It all adds up to a static picture, with the SPP stuck within a very narrow band. Since it breached the £2/kg barrier in mid-September, it has never gone above 200.55p/kg, without ever dipping below 200p/kg.

The SPP remains 54p ahead of a year ago, however.

The APP is following the same pattern. It fell back by 0.16p during the week ended October 29, to 204.02p/kg, 3.8p ahead of the SPP.

However, producers continue, on average, to lose money on every pig sold. New figures from AHDB estimated an average cost of production for October of 232p/kg, up from 224p/kg in September as feed costs rise again, alongside rising interest rates and higher fuel and energy prices, meaning producers were losing on average, around £26- £28/pig.

EU prices are falling, as the impact of poor consumer demand and inflation have more than outweighed reduced supplies. The EU reference price was down a further 4p to 172.18p/kg in the week ending October 30, increasing the gap to the equivalent UK reference price to beyond 28p.

The downward trend in carcase weights continued, with average weights down 0.8kg to 89.46kg in the week ending November 5, the first time below the 90kg mark since mid-September.

Estimated GB pig slaugherings stood at 173,316 in the week, around 7,000 down on the previous week, and 6,500 down on a year ago.

November 9, 2022

Average costs rising again

New data from AHDB shows the average costs of pig production increased to 232p/kg, up from 224p/kg in September.

This means, with the SPP stuck at around £2/kg, pig producers were estimated to be losing, on average, £26 to £28 per pig slaughtered.

Rising feed costs, interest rates and energy and fuel prices have all contributed to the rise.

More HERE.

November 4, 2022

Morrisons' Farmer Christmas ad is back

It might seem way too early to start thinking about Christmas, but Morrisons has again shone the spotlight on British farmers in its version.

It is bringing back Farmer Christmas for the second year. In the supermarket’s 60-second TV ad, Farmer Christmas is seen journeying through fields on his tractor, to visit his festive workshop where a series of elves are hard at work preparing Morrisons Christmas dishes.

In the ad, a butcher passes Farmer Christmas a glazed gammon joint, which is described as a ‘big edible Christmas present’, while a Morrisons baker is shown preparing puff pastry mince pies in ‘magic’ ovens.

The aim of the campaign is to spotlight Morrisons’ own colleagues – many of whom feature in the ad – and farmers, who are the 'real life elves' that produce more than half of the fresh food that the supermarket sells.

You can view the advert here: https://www.youtube.com/watch?v=6oE0JuPHc-M

November 3, 2022

SPP dips again, as recent pattern continues

The pattern of the past weeks continues, as the EU-spec GB SPP has dipped again, following the previous week's increase.

The SPP was down by 0.21p to reach 200.22p/kg in the week ending October 29. This was after it bounced back the previous week, rising by 0.34p to reach 200.43p/kg, following a small dip, which, in turn followed a small rise.

It all means the SPP has barely moved since breaking the £2/kg barrier in mid-September. While never falling below that mark in the six weeks that have followed, it has never been higher than 200.55p/kg.

The SPP remains more than 55p ahead of a year ago, however.

The APP also increased by 0.51p back during the week ended October 22, to reach 204.18p/kg, 3.8p ahead of the SPP.

Recent AHDB figures estimated an average cost of production for September of 224p/kg as feed costs remain unsustainably high, meaning producers were still losing on average, around £18- £20/pig.

EU prices are falling, as the impact of poor consumer demand and inflation have more than outweighed reduced supplies. The EU reference price was down a further 2p to 176.35p/kg in the week ending October 23, 24p below the equivalent UK reference price.

The downward trend in carcase weights continued for the second successive, with average weights down 0.2kg to 90.34kg in the week ending October 29, still around 3kg heavier than August levels.

Estimated GB pig slaugherings stood at 180,329 in the week ended October 29, around1,000 down on the previous week, but 1,000 up on a year ago.

November 2, 2022

FSA strike action averted, after ballot

Some much-needed good news for the industry. A potentially hugely damaging strike by FSA meat inspectors and other staff has been averted, following a ballot of UNISON members.

UNISON, the UK’s largest union, had warned that the dispute involving several hundred inspectors, vets, and office-based staff in England, Wales and Northern Ireland could result in strikes in the run up to and over Christmas leading to less meat on supermarket shelves. The BMPA said the strike could have brought parts of the industry to a 'standstill'.

But the three-week ballot of FSA employees, which closed on Monday (October 31), fell short of the numbers required to bring about strike action.

A UNISON spokesperson said: “Staff showed strong support for taking action over their inadequate pay offer, but by the narrowest possible margin, turnout didn’t meet the legal threshold.”

The outcome means FSA staff will receive a 2-5% pay increase.

Full story HERE

October 27, 2022

SPP back up after last week's dip

After last week's dip, the SPP has bounced back, rising by 0.34p to reach 200.43p/kg in the week ending October 22.

It has recovered most of the 0.46p lost the previous week to stand at its second highest level ever. The index breached the £2/kg barrier in the week ended September 17, but has so far hit a ceiling of 200.55p/kg, as small gains since have been interspersed with a couple of backward moves. The SPP remains nearly 52p ahead of a year ago, however.

The APP also fell back during the week ended October 15, down 0.25p to 203.67p/kg, 3.6p above the SPP.

Recent AHDB figures estimated an average cost of production for September of 224p/kg as feed costs remain unsustainably high, meaning producers were still losing on average, around £18- £20/pig.

EU prices are falling, notably in Germany and this is affecting other markets. The EU reference price was down by just over 1p to 178.28 in the week ending October 16, 22p below the equivalent UK reference price.

Estimated GB pig slaugherings stood at 181,200 in the week ended October 22, around1,500 up on the previous week but 7,000 down on a year ago.

Average carcase weights were down 0.34kg to 90.54kg, still around 3kg heavier than August levels.

October 21, 2022

Pilgrim's invests £800,000

Pilgrim’s UK has announced an £800,000 investment in its Bromborough site as part of its ongoing strategy to maximise operational efficiency across its UK operations.

Two new inline processes have been installed at the site, a benchmark for operational excellence within the industry, and are now operational.

More HERE

October 20, 2022

SPP falls back, as EU prices dip, too

The EU-spec GB SPP fell back by 0.46p to 200.09p during the week ended October 15, in a further blow to pig producers who continue to face unsustainable production costs.

The average pig price, which breached the £2/kg barrier in September, fell back for the first time in seven months during the week ended September 24, but rallied again over the next fortnight to hit a record of 200.55p/kg last week.

The SPP remains nearly 55p higher than a year ago. However, new AHDB figures estimated an average cost of production for September of 224p/kg meaning producers are still losing, on average, around £18- £20/pig.

The APP for the week ended October 8 was up by a further 0.34p to 203.92, 3.37p above the SPP.

The EU reference price fell by a massive 5p to 180.59 in the week ending October 9 on the back of big dips in the German and Dutch prices. While the gap has closed since the summer, this put it nearly 21p behind the equivalent UK reference price.

Estimated GB pig slaugherings stood at 179,700 in the week ended October 15, around 900 down on the previous week but 2,700 higher than a year.

The upward trend in carcase weights continued, after a slight reduction the previous week. Average weights hit 90.88kg, 3kg heavier than early August levels.

October 19, 2022

FSA staff balloted for strike action in threat to Christmas meat trade

Staff at the Food Standards Agency (FSA) are being balloted for strike action that could affect meat supplies during the festive season, the union UNISON today has warned.

The dispute involving several hundred inspectors, vets, and office-based staff in England, Wales and Northern Ireland could bring the industry to a halt, according to the union.

Full story HERE

Industry losses top £700m, as costs of production remain stubbornly high

Cumulative industry losses since since autumn 2020 have now topped an £700m, as British pig producers continue to lose, on average, £18 to £20 per pig produced.

Costs of production remain at unsustainably elevated levels, according to new figures from AHDB. The full economic cost of production was estimated to be 224p/kg deadweight in September, assuming average technical performance was similar to the 12 months ending 30 June 2022.

With wheat prices remaining at unprecedented levels, this is slightly up on the August figure of 223p/kg but below July, 231p/kg, and the Q2 average of 240p/kg.

With the SPP averaging 200p/kg and the APP 203p/kg, on a full economic basis, pig producers performing at an average level of technical performance will be losing £18 to £20 per pig slaughtered.

However, some producers, performing in the top third, will now be in a break-even situation or possibly seeing a small positive net margin, AHDB said.

More HERE

October 13, 2022

NPA response to Defra consultation on pig contracts

You can now view a summary of the NPA's response to the consultation, including our eight key asks, HERE. We will be issuing a press release soon.

In terms of individual responses across the industry, the signals from Defra are that these picked up markedly over the past week or so.

Writing on the forum today, NPA vice chair Hugh Crabrtree said the 'word on the street was that Defra are really pleased with the response to their supply chain review from the pig sector'.

"Bloody well done people and thanks very much indeed for your time and effort," he said.

SPP up again

The EU-spec GB SPP continued moving in the right direction in the week ended October 8, inching up by 0.18p to reach 200.55p/kg.

This is the second successive weekly increase, following the reverse in the week ended September 24.

However, the rate of upward progress continues to slow. The SPP has risen by less than 0.6p over the past four weeks, although the price the index is 44p above where it was a year ago.

However, average prices remain below average costs, estimated by AHDB at 221p/kg for August, with many producers still losing money on a weekly basis.

The APP was back up by nearly a penny, 0.9p, for the week ended October 1 at 203.57p/kg, meaning the gap between it and the SPP stood at 3.2p.

For the week ending October 2, the EU Reference stood at just short of 187p/kg, compared with a UK reference price of 200.7p/kg, the gap of under 14p comparing with more than 30p at some points in August. However, the rise in EU prices has stalled, with some key pig producing nations recording falls in recent weeks.

Estimated GB pig slaugherings stood at 174,400 in the week ended October 8, 900 up on the previous week but down by nearly 10,000 on a year ago.

The upward trend in carcase weights was halted, with the average of 90.28kg fractionally down on the previous week but still 3kg heavier than early August.

October 6, 2022

SPP heading back in right dircection, carcase weights rising, too

Pig prices are heading back up again, after last week's dip, although carcase weights are continuing to rise.

The EU-spec GB SPP increased by 0.36p to reach 200.37p/kg for the week ended October 1, following the previous week’s 0.21p backward step.

The previous week’s reverse was the first since February - although it came from a relatively small sample and unusual trading week due to the bank holiday held for the Queen’s funeral.

The APP was down by nearly a penny for the week ended September 24. At 202.68p/kg, the gap between it and the SPP was just 2.67p.

Pig producers will, however, be hoping the return to an upward trend for the SPP is a sign of things to come, with average costs – estimated by AHDB at 221p/kg for August – still above average prices, and many businesses continuing to lose money on a weekly basis. The industry is estimated to have lost, collectively, more than £600m since late-2020.

With recent market reports suggesting 'flat demand' for British pork products, as trade data shows a substantial increase in pork imports during the first seven months of this year, the gap between EU and domestic prices is key in terms of the UK pig market outlook.

In the week ended September 25, the EU reference price was 185.46, following steady increases since mid-August on the back of tighter EU supplies. This narrowed the gap to the UK price to just over 14p, compared with more than 30, not many weeks ago. While that is good news, a hefty fall in the German price last week is not.

Concerningly, amid reports of pigs being rolled again, carcase weights rose for the sixth consecutive week, and now stand at 90.4kg, 3kg heavier than in mid-August.

Estimated GB slaughterings stood at 173,512 for the week ended October, significantly up from the previous shortened week, but slightly down on the week ended September 17 and up by around 3,500 head on a year ago.

October 4, 2022

New Defra Secretary makes 'British' labelling commitment

Beneath all the noise emanating from the Conservative Party Conference in Birmingham, there was an interesting line in new Defra Secretary Ranil Jayawardena's speech, which he delivered yesterday.

Mr Jayawardena has indicated he will introduce new ‘British’ labelling to tighten up loopholes that currently allow UK pork to be labelled as British. The example he used to explain the need for change was interesting.

“We have some of the highest animal welfare standards in the world. Shoppers vote with their feet and choose to buy British for just that reason. And yet, did you know that Danish pork processed in Britain can be sold as British?”

He promised to launch new British labelling, 'so that the people of our great nation can have confidence that anything labelled as British IS British'.

Full story HERE

September 29, 2022

SPP drops back for first time since February

Just a week after hitting the £2/kg mark, the SPP took a backwards step for the first time since February.

The average pig price price was down 0.21p in the week ending September 24 to remain fractionally above £2/kg. The fall means the SPP has only moved up by 1.7p over the past four weeks.

Last week, Karro reduced its weekly contribution price by 5p, although this might have come too late to affect the SPP.

September 27, 2022

Have you responded to the Defra review yet?

With less than two weeks remaining until the Defra supply chain consultation closes, NPA chief policy adviser Rebecca Veale has urged all those in the industry to respond.

Interviewed on Lincolnshire FM's Farming Programme, Rebecca set out the broad principle's of the NPA's response and also explained why it is so important that individuals respond.

You can listen HERE (from about 20 minutes).

There are 44 questions, seeking views on issues such as transparency, price reporting, clarity of contractual terms and conditions, and market consolidation. The consultation, published in July, runs until October 7.

- You can complete it HERE

The NPA has issued guidance on how to respond for members. You can view it in the Members' Area.

If you need to discuss your response, email Rebecca -

Countryfile focuses in on pig crisis

NPA chairman Rob Mutimer warned that independent pork producers could virtually disappear as Countryfile highlighted the scale of the pig crisis.

In a 10-minute feature, which can be viewed here, a number of pig farmers, including Chris Fogden (right), who is quitting production, Kate and Vickie Morgan, Simon Watchorn, Anna Longthorp and Stephen Thompson, explained how the crisis is affecting them.

More HERE

September 26, 2022

Karro drops contribution price by 5p

Karro has dropped its weekly contribution price by 5p, following warnings from its chief executive that demand for British pork needs to increase to prevent the pig price falling.

Karro’s move on Friday leaves contribution prices from the big processors at between 175 and 190p, according to industry consultant Peter Crichton.

Prices are typically based on a mix of the contribution price, the SPP and sometimes the Weekly Tribune price, with some retailers recently introducing a cost of production element.

Last week, in an interview with Pig World, Karro chief executive Steve Ellis said the pig price has been supported ‘over and above the market level’ by processors and retailers for a number of months now.

More HERE

September 23, 2022

Lizzie backs Karro 'buy British' message, but issues warning on pig prices

NPA chief executive Lizzie Wilson has backed calls from Karro boss Steve Ellis for the pork supply chain to buy more British, but has warned that pig prices must not be cut in the face of weak demand.

In an interview with Pig World, Mr Ellis said demand for British pork must increase urgently in order to sustain current pig prices.

He said the weak demand for British products, in the face of a 'flood' of cheaper imports, meant there still a surplus of British pork, despite the contraction of the UK pig herd. "The overriding message is that we have to sell more British pork, or the price will have to drop,” he said.

Responding, Lizzie said: "The NPA is absolutely 100% behind the message that we need to move more British pork through the supply chain, starting with the big retailers who have the power to make the difference.

“We welcome the efforts made so far by some players in the chain to back British pig farmers and to invest in the pig price to support desperate producers.

“But demand for British pork is floundering in the face of pressure on shoppers pockets and cheaper imports – if this continues, the contraction we have seen in the sow herd in the space of a year will just continue.

“We urgently need to stem the bleeding. Consumers can help by actively seeking out high quality, high welfare, environmentally-friendly Red Tractor British pork – and we urge retailers, processors and buyers from the foodservice sector to prioritise British pork over imports, wherever possible.

“Pork is still very competitively priced and provides excellent value for money as budgets are increasingly being squeezed.”

Mrs Wilson also stressed that any price cuts for British pig producers now could be catastrophic at a time when costs remain sky high.

“Pig producers lost £50/pig in the second quarter of this year and have endured cumulative losses of £600m since late 2020. Price cuts now could be the final straw for many,” she said.

Keep an eye out for Countryfile on Sunday

Countryfile have recently filmed an update on the pig industry crisis, which is due to air on Sunday.

NPA Chair Rob Mutimer has been interviewed, as well as various producers on their units or via video diaries. The piece will also feature an interview with BMPA’s Nick Allen.

September 22, 2022

SPP hits £2/kg, but rate of progress slowing

The SPP has finally hit £2/kg, rising by 0.3p to 200.22p/kg last week. While the landmark is welcome, the pace of upward movement is slowing markedly - this was the smallest increase since early March.

Meanwhile, the APP was marginally down the previous week, ending September 10, falling 0.18p to 202.61p/kg.

On average, prices remain below cost of production, estimated by AHDB at 221p/kg for August.

Septmember 16, 2022

Goldsmith sacked as Defra Minister - reports

Conservative peer Zac Goldsmith has been sacked as a Defra Minister, according to media reports.

Lord Goldsmith, a close friend of former Prime Minister Boris Johnson and wife Carrie, is still listed as a Minister on the Defra website. However, official announcements on new Prime Minister Liz Truss’s Ministerial appointments have been put on hold during this period of official mourning.

The Guardian reports that, in a farewell letter to staff at Defra, Lord Goldsmith said he was ‘very sad’ to be leaving after a ‘whirlwind’ three years.

More HERE

SPP up again, but still short of £2-mark - and of COP

The SPP inched up by another 0.4p last week to reach 199.93p/kg, meaning that £2/kg mark remains elusive.

While the average pig price is still rising, the rate of increase has markedly slowed of late. The average for the four weeks ending September 10 was 198.98p/kg, 3p up from the average price for the previous four-week period.

The EU-spec APP has been following the same trend - in the week ending September 3, it reached 202.79p/kg, bringing the four-week average to 201.71p/kg.

Prices still remain some way off covering the cost of production for many farmers, as inflation has driven up input costs, especially for feed and energy - AHDB estimated an average COP of 221p/kg for August.

After Defra's June Agricultural Survey showed a 18% reduction in the English sow herd - and pig businesses remain in an extremely vulnerable position.

AHDB's latest forecast anticipates a 6% fall in pig meat production by the end of 2022, driven by a 15% drop in clean pig slaughter in the second half of the year.

Carcase weights

Carcase weights averaged 88.61kg in the week ending September 10, bringing the average for the four-week period to 88.04kg, an increase of 490g compared to the previous four weeks. Weights peaked at the end of January when they sat 10kg above the 5 year average, due to the backlog.

Since then, carcase weights have been gradually decreasing as processors made progress on the backlog. Weights steadied at the end of July and through August, and are now sitting below the recorded weights from this time last year.

Clean slaughter

Estimated clean pig slaughter for the four weeks ending September 10 was 654,300 head, down 8,400 head compared to the previous four weeks. Year-to-date slaughter (Jan 2- Sep 10) stands at 6.39 million head, down 1% on last year.

September 15, 2022

Supply chain review - Find the time to respond!

The latest post on the forum is an impassioned for all industry stakeholders to take the time to make their voice heard in Defra's pork supply chain review.

"Yes, the NPA are submitting a formal document in response. But please, please do not make this an excuse for not responding yourself - whoever you are," the poster writes.

"The passion and commitment of those at the coalface of this crisis is an absolute essential ingredient - especially now. So, I say again to all you industry stakeholders reading this: follow the link and set about responding."

You can complete the consultation HERE

The NPA has issued guidance on how to respond for members. You can view it in the Members' Area.

September 14, 2022

Sun readers alerted to ongoing pig industry problems

The Sun has highlighted the ongoing problems facing the UK pig sector, quoting NPA warnings the impact of falling production on the availabilty and reinforcing the vital buy British message.

You can read the article HERE

September 8, 2022

Pilgrim's to close to two sites and cut Ashton to four days, after £16m loss

Pilgrim's UK is planning to close its Bury St Edmunds and Coalville sites and reduce production at Ashton to four days, with the potential loss of nearly 700 jobs.

The move has been announced after the company's latest Annual Report and Accounts revealed it recorded an operating loss of £16 million in 2021, on the back of the challenges facing the pig sector. Pilgrim's said the proposed plant closures were part of a business recovery plan across its UK operations.

The existing operations at the two closed plants will transfer to sites at Corsham, Kings Lynn, Linton and Andover.

The changes will affect around 290 employees at Bury St Edmunds, 350 at Coalville and 35 at Ashton, putting them at risk of redundancy.

Rachel Baldwin, vice president of HR for Pilgrim’s UK, said: “The decision to propose the closure of our Coalville and Bury St Edmunds sites and put a number of roles at risk at Ashton has not been taken lightly, but is unfortunately essential to help our business recover and secure a sustainable future for all of our team members across the UK.

Full story HERE

September 7, 2022

New Defra team takes shape

The new Defra team under Prime Minister Truss is taking shape.

After yesterday evening's announcement that Ranil Jayawardena had taken over from the sacked George Eustice as Defra Secretary, today former Chief Whip Mark Spencer was unveiled as the new Minister of State at the Department.

He takes over from Victoria Prentis, who is moving to the Department of Work & Pensions.

Mrs Prentis has been a strong ally of the pig sector and the NPA's Lizzie Wilson and Charlie Dewhirst thanked her for her support on Twitter.

Lizzie said: "So sorry to lose you minister, as you have been so understanding and supportive. Your attention and urgency throughout this very challenging period has really been appreciated by our pig producer members. Good luck with the new position!"

Charlie said: "Thank you for all the support you have given to the British pig industry during these last two years. It has been an enormously challenging period but we were always grateful for your determination to help us through the crisis. Very best of luck in the new role!"

New data highlights scale of industry contraction

As AHDB data highlights the devastating impact of the pig industry crisis on incomes over a prolonged period, new Defra figures shed fresh light on the impact this is having on the size of the national pig herd.

The English pig breeding contracted by 18% in the space of a year, Defra’s June Agricultural survey reveals.

The figures show the female breeding herd in England was down to below 261,000 in June, compared with 313,000 in June 2021, confirming the loss of more than 50,000 sows and gilts.

This was the lowest breeding herd figure in the past 20 years, with large decreases seen across all categories, with a 28% decline in gild numbers, and proportionally lower drops in in-pig sows (-14%), and dry sows (-18%). ‘Other breeding pigs’, including boars, also saw a decrease in 2022, falling by 24% from 90,000 to 68,000.

The contraction of the breeding herd is not reflected in overall pig numbers in the June survey – the overall English pig herd decreased by 3% over the year to just over 4.1 million animals, with fattening pig numbers, accounting for 92% of the total, down just 1.4% to 3.8, over the 12 months.

But AgroVision’s latest anonymised pig herd data for the UK, up to July, does give some insight into the shortfall in production that is coming.

It shows a 17% year-on-year decline in the sow herd, alongside a 23% decline in the number of services recorded in July, and a 30% annual decline in weaner numbers, although the three-month rolling average shows a more accurate 17% year-on-year decline.

NPA chief executive Lizzie Wilson described the latest figures from Defra and AgroVision as ‘deeply worrying, although not surprising’.

More HERE

Shocking new figures highlight scale of pig sector's financial crisis

The latest AHDB quarterly cost of production and margin estimations for Q2 show producers lost, on average, £52/pig (58p/kg) in Q2

This follows losses of £58/pig in Q1 and £39/pig in Q4 2021, meaning producers have now endured seven successive quarters of negative margins, with cumulative losses now estimated at £600 million since autumn 2020.

While the average pig price rose rapidly, from 146p/kg in Q1 to 183p/kg in Q2, so did average costs, as the impact of the Ukraine war on cereal prices hit hard.

Spot compound feed prices have continued to ease since May 2022 high, meaning average costs have come down to 231p/kg in July and 223p/kg in August, according to the latest AHDB estimate.

But with pig prices hovering around the 200p/kg mark, producers are still, an average, enduring significant losses.

Numerous producers have already been forced to quit, and many more have reduced their sow herds, as reflected in the June Defra Agricultural Survey, which shows a 17% year-on-year decline in the breeding herd.

Sadly, we continue to hear of more producers, who can no longer sustain losses of this magnitude, going out.

August 25, 2022

SPP closes to £2kg mark, APP already there

The GB EU-spec SPP edged closer to the 200p/kg mark last week, averaging 198.06p/kg, up 0.66p on the week and now 39p higher than last year, and 41p above the five-year average.

Domestic prices have been helped by rising European prices over the last few weeks, with tighter supplies reportedly being met with an uplift in demand towards the end of the holiday season.

However, the rate of increase has markedly slowed and prices remain well below average costs, estimated at 231p/kg in July. Reports of well-known pig businesses being forced to quit or significantly restructure continue, with a sho